Guardian readers may have noticed that the Labour leadership has committed the party to maintain (i.e., not reverse) the cuts by the Coalition planned for the current budget in 2015-2016, though not the investment budget. This means that if Labour wins the next election, fewer resources for the NHS, schools and social protection, to name the most obvious.

To justify the conversion to Coalition cuts, Labour points out that the Attlee government during 1945-1951 held to a balanced budget while bringing about radical change, so what stops Labour from achieving the same now? (If you are not fully on board with this cut commitment, go to and join the People’s Assembly movement.)

The short answer to the question, what stops Labour from doing the same in 2015, is, “just about everything”. First, while I could be wrong, I think it is unlikely that Labour would seek a balanced budget by raising the highest income tax rate from the current 45 percent to the level established by the Attlee government in 1949 (98 percent, as in [100 – 2]).

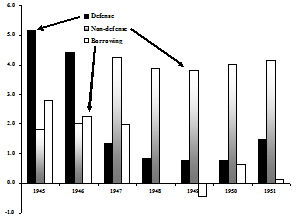

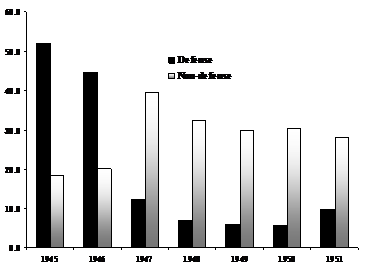

Second, the Attlee government did, indeed, preside over a dramatic reduction in both public current expenditure and public borrowing. This resulted from reduction in defence expenditure from five billion pounds in 1945 (52 percent of GDP) to less than one billion in 1950 (5.6 percent of GDP, Charts 1 and 2). The reduction resulted not from bold cuts as such, but from the end of an event usually called the Second World War, which produced a massive “peace dividend”. Even if so inclined, with military expenditure now at three percent of GDP, a Labour government would not squeeze much social spending from defence cuts.

The boldness by the Attlee government came with the use of that “peace dividend” for the newly created National Health Service, schools and pensions, to list the most obvious. From 1945 to 1947, non-defence expenditure more than doubled as a share of national income, from 18.3 to 39.5 percent. I doubt that Labour Leadership plans to double social expenditure should win the next election.

Finally on Labour’s factual errors about 1945-51, the Attlee governments did not run a surplus during six years in power. The government balanced the overall budget in 1948 and ran a slight surplus in 1949 (borrowing was negative). However, at the end of 1951 the public debt was nineteen percent greater than at the end of 1945 in current prices. The debt to GDP ratio declined from 216 percent to 175 percent, a decline that resulted from economic growth, not budget cuts.

To put the matter simply, the problem facing the Labour government in 1945 was not debt or deficits. An unsustainable balance of payments represented the bête noir of Attlee’s government, prompting continued rationing and strict foreign exchange controls (the Labour leader in his speech specifically cited the ban on imports of sardines, perhaps not the most onerous of the import restrictions).

Chart 1: UK central government expenditures and borrowing, 1945-1951

(billions of pounds in current prices)

Chart 2: UK central government expenditures, 1945-1951

(percentage of GDP)

Third and back to the present day, the Labour Leadership seems not to have noticed that the Coalition Chancellor has definitively demonstrated that expenditure cuts cannot balance the national budget in Britain. The Chancellor smugly tells us that public borrowing for fiscal year 2012/13 dropped by almost £35 billion compared to fiscal year 2011/12, and Labour appears to believe him. To the Chancellor’s chagrin, the Treasury tells quite a different story.

When the fiddles are netted out (transfers from the Royal Mail Pension Plan and the Bank of England Asset Purchase Facility), the fall in borrowing comes in at £300 million (with an “m”, not a “b”).* At that rate of decline, the Chancellor would need to keep at his cuts beyond 2015/16, for another 115 years to be more precise. In other words, should Labour win the next election and implement the Coalition cuts, further disaster would result (a real Balls-up, one might say).

A balanced budget is not lesson to take from the Labour governments of 1945-1951. The correct lessons for “radical” action, to use Labour’s adjective, are: 1) heavily tax both the income and wealth of the rich, 2) dramatically increase social expenditure, 3) borrow if necessary to do the previous, and 4) introduce exchange controls.

Go for it, Ed.

Thanks for this John. I recently read The Road to 1945 by Paul Addison. We are so far from the possibility of that moment.

A very insightful analysis John, which successfully highlights just how woeful Labour’s current grasp on economics is! Unfortunately this has been the case for some time now…

No need to increase taxes. Update the 1844 Banking Act & print own money without having to pay interest. Introduce Land Tax. Implement a basic income for all (no need for full employment) – get rid of all bureaucratic structures (eg benefit system/student loans). Invest in infrastructure and social housing. Do not renew Trident. Develop good relationships with all countries. Introduce a “strong” anti-corruption law. Prisons is only needed for “dangerous” citizens – community service instead of prison.

It’s going to a hard time sorting out which party I will need to vote for, Hard Tory or Tory lite, I think I’ll sit at home because I cannot go through another five years of a so called socialist party making another mess.

Miliband and Balls dear god who thought those two would be worthy, in all honesty I’m not to sure which party is the most conservative..

Oh I forgot it was me after being asked by my Unions to Vote For Ed to defeat his brother, but maybe his brother may have been able to speak unlike Miliband the jnr

Love Arvind’s idea of a basic income for all. Having got a little in savings, that “guaranteed income” would see me nicely through to state pension age, and the thought of Arvind slaving away to put the tax revenue in to pay me while I put my feet up would make it even nicer.